This week has brought ups and downs for the gold price as US President Donald Trump’s tariff decisions continue to create widespread uncertainty across sectors globally. The yellow metal started the week at about US$3,020 per ounce, but quickly tumbled below the US$3,000 level as markets around the world took…

The copper price began 2025 on a rebound, spending time above US$5 per pound during Q1 after trading within the US$4 to US$4.50 per pound range for most of 2024’s second half. Starting strong, the red metal climbed from US$3.99 on January 2 to reach US$4.40 by mid-month. It then…

Shifting political winds and tech advancements defined the cleantech sector in the first quarter of 2025. This cleantech market update will explore the key trends and challenges that shaped the sector in Q1, with a focus on electric vehicles (EVs), autonomous driving technologies and renewable energy. From shifting regulatory landscapes…

Galan Lithium (GLN:AU) has announced Suspension from Quotation Download the PDF here. This post appeared first on investingnews.com

Tartana Minerals (TAT:AU) has announced Tartana executes HOA to process Copper Ore in Mungana Plant Download the PDF here. This post appeared first on investingnews.com

Spearmint Resources Inc. (CSE: SPMT) (OTC Pink: SPMTF) (FSE: A2AHL5) (the ‘Company’ or ‘Spearmint’) wishes to announce that it has significantly increased the acreage of the ‘Sisson North Tungsten Project’ in New Brunswick directly bordering the Sisson Tungsten Mine. This new project now consists of approximately 4,890 contagious acres increased…

In 2024-2025, the United States significantly escalated its trade conflict with China through new tariffs, including a substantial 100% tariff on electric vehicles and 50% on essential technologies like semiconductors and solar products. These measures amplify the existing trade tensions and represent a profound shift towards economic decoupling between the…

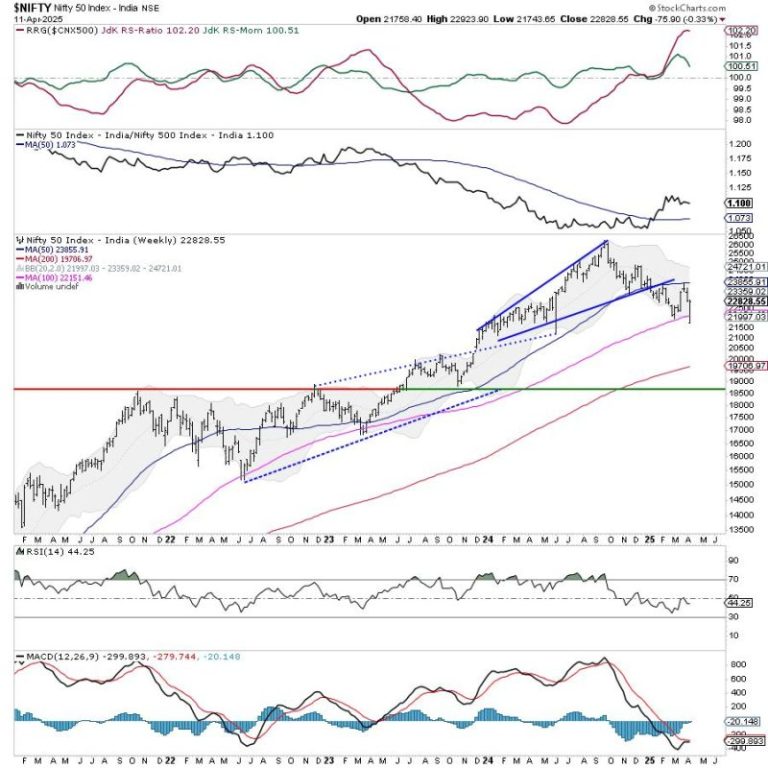

The previous weekly note categorically mentioned that while the markets may continue to decline, the Indian equities are set to outperform its global peers relatively. In line with this analysis, the market saw wide swings owing to prevailing global uncertainties but continued showing remarkable resilience against other global indices. The…

Stock market rally, sector rotation, and earnings movers dominate this week’s analysis with Mary Ellen McGonagle. In this video, Mary Ellen reviews where the market stands after last week’s bounce and explains how White House activity drove major price action. Mary Ellen also highlights two top-performing sectors that outpaced the…

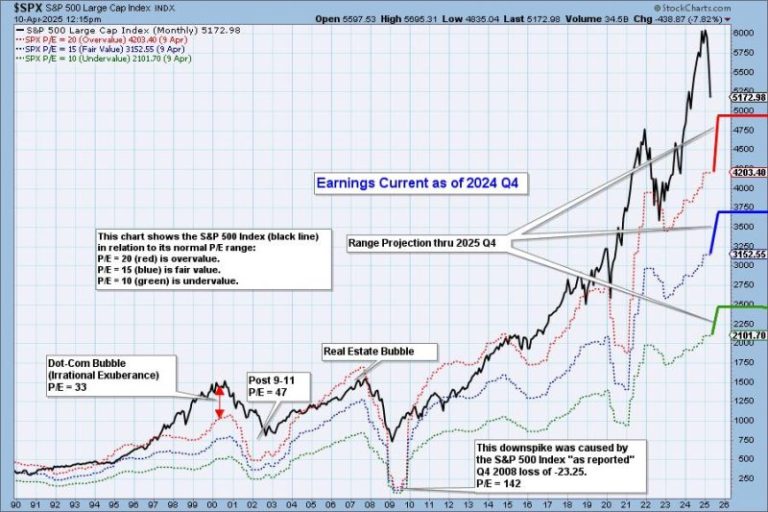

S&P 500 earnings are in for 2024 Q4, and here is our valuation analysis. The following chart shows the normal value range of the S&P 500 index ($SPX), indicating where the S&P 500 would have to be to have an overvalued P/E of 20 (red line), a fairly valued P/E…