President Donald Trump spent his 17th week as commander-in-chief visiting the Middle East, marking his first major overseas trip of his second term. The president left Washington, D.C., Monday for Saudi Arabia, followed by a visit in Qatar and the United Arab Emirates. The president’s trip comes amid the continuing…

As the global energy transition accelerates, the mining sector is increasingly navigating a complex landscape of shifting demand, volatile prices and growing sustainability priorities. During an S&P Global webinar on the state of the mining industry in Q1, analysts highlighted renewable power development and mine-site electrification as key sustainability drivers…

Virtual Investor Conferences, the leading proprietary investor conference series, today announced the agenda for the Precious Metals & Critical Minerals Hybrid Virtual Investor Conference. Individual investors, institutional investors, advisors, and analysts are invited to attend. This in-person and virtual event will showcase live company presentations and interactive discussions featuring Precious…

The Justice Department isn’t planning to prosecute Boeing in a case tied to two crashes of the aerospace giant’s 737 Max, a person familiar with the matter said, a tentative agreement that would allow the plane-maker to avoid a guilty plea. Boeing agreed to plead guilty in the case last summer in a deal with…

Looking for breakout stocks and top market leaders? Follow along Mary Ellen shares stock breakouts, analyst upgrades, and sector leadership trends to help you trade strong stocks in today’s market. In this week’s episode, Mary Ellen reveals the stocks leading the market higher and explains what’s fueling their strength. She…

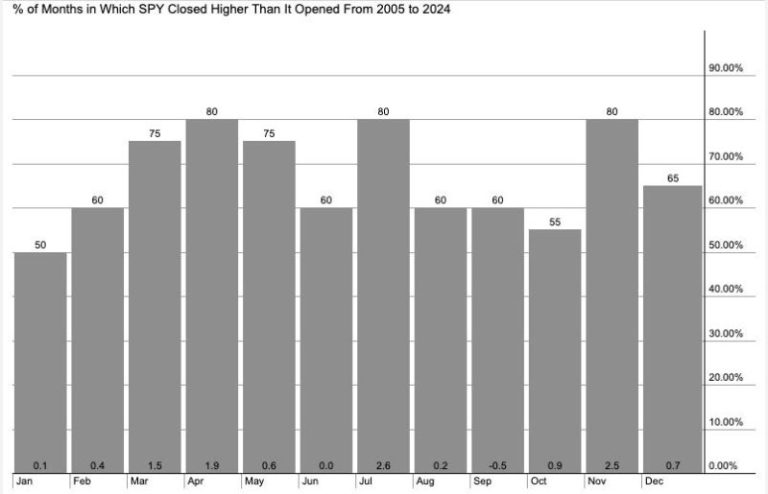

We’ve all heard the classic market maxim, “Sell in May and go away.” For many investors, that’s the introduction to market seasonality that suggests a six month period where it’s just best to avoid stocks altogether. Through my own experience, complemented with interviews with seasonality experts like ” We’ll dig…

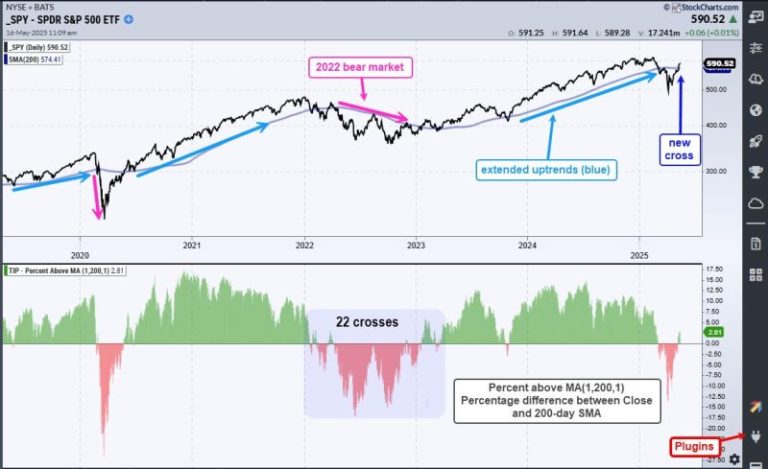

If you didn’t check in on the stock market the last couple of weeks, you might be surprised to see how strong they were this week. The three major stock indexes — S&P 500 ($SPX), Nasdaq Composite ($COMPQ), and Dow Jones Industrial Average ($INDU) — broke through their 200-day simple…

SPY and QQQ crossed above their 200-day SMAs with big moves on Monday, and held above these long-term moving averages the entire week. The V-Reversal was extraordinary and SPY seems short-term overbought, but this cross above the 200 day SMA cross is a bullish signal for the most important market…

For those of you who are a bit more steeped in technical analysis, you’ve likely heard of Dow Theory. A set of principles developed from Charles Dow, a journalist/analyst who founded what’s now the Wall Street Journal back in the late 19th century, Dow’s insight was foundational to modern technical…

The S&P 500 ($SPX) just staged one of the sharpest rebounds we’ve seen in years. After tumbling into deeply oversold territory earlier this year, the index has completely flipped the script—short-term, medium-term, and even long-term indicators are now pointing in a new direction. One longer-term indicator that hit an extreme…