When Tim Cook gifted President Donald Trump a gold and glass plaque last month, the Apple CEO was hailed by Wall Street for his job managing the iPhone-maker’s relationship with the White House. Cook, Wall Street commentators said, had largely navigated the threat of tariffs on Apple’s business successfully by…

Shares in the Trump family’s latest cryptocurrency made its stock market debut Wednesday, triggering more ethical concerns as the Trumps look to cash in on crypto as the president’s administration weakens regulations for the nascent industry. American Bitcoin, a firm co-founded this spring by Eric Trump, the president’s son, saw…

David Ellison continues to put his stamp on Paramount after its acquisition by Skydance. The CEO and chairman told employees Thursday that they will be expected to work in the office five days a week starting Jan. 5, 2026, according to a memo obtained by CNBC. Employees who do not…

Eight fighter jets will conduct a flyover when Polish President Karol Nawrocki arrives at the White House Wednesday morning, Fox News Digital has learned. President Donald Trump’s meeting with Nawrocki, whom Trump backed in the Polish elections earlier in 2025, comes amid ongoing negotiations between Poland’s neighboring Russia and Ukraine…

President Donald Trump lashed out at a reporter who claimed he has taken ‘no action’ against Russia since taking office on Wednesday. The exchange came as Trump was holding a bilateral meeting with Polish President Karol Nawrocki at the White House. Trump took questions from the press, and one reporter…

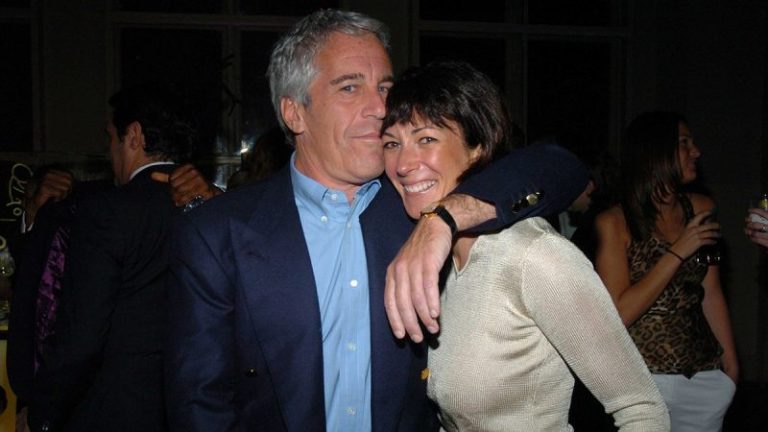

A lawyer representing victims of Jeffrey Epstein said Wednesday that the American public is ‘going to be appalled’ about documents relating to the disgraced late financier that have not been released by the federal government. ‘The government has mistreated them after Jeffrey Epstein mistreated them,’ Bradley Edwards said of the…

President Xi Jinping declared China’s ‘great rejuvenation’ unstoppable on Wednesday as he used the country’s largest-ever military parade to hint at reunification with Taiwan and to flaunt advanced weapons designed to rival American power. Xi said the People’s Liberation Army (PLA) would ‘resolutely safeguard national sovereignty, unity and territorial integrity,’…

Leading members of President Donald Trump’s political team met Wednesday behind closed doors with House Republicans to offer what’s being described as a ‘clear and simple’ message to sell the GOP’s sweeping domestic policy package to Americans. The sales pitch, from top Trump pollster Tony Fabrizio, senior Trump political aide…

Leading members of President Donald Trump’s political team met Wednesday behind closed doors with House Republicans to offer what’s being described as a ‘clear and simple’ message to sell the GOP’s sweeping domestic policy package to Americans. The sales pitch, from top Trump pollster Tony Fabrizio, senior Trump political aide…

The House Budget Committee has begun having early discussions on a second Republican megabill, eyeing more potential reforms to Medicaid, sources told Fox News Digital. Republicans on the panel are expected to hold closed-door talks in the coming days, as lawmakers return from the August recess, three people familiar with…